Executive Summary

The Holy Land Foundation for Relief and Development (HLF) stands as one of the most significant terrorist financing cases ever prosecuted in the United States, not because it funded specific attacks, but because it financed the social and institutional infrastructure of a designated terrorist organization.

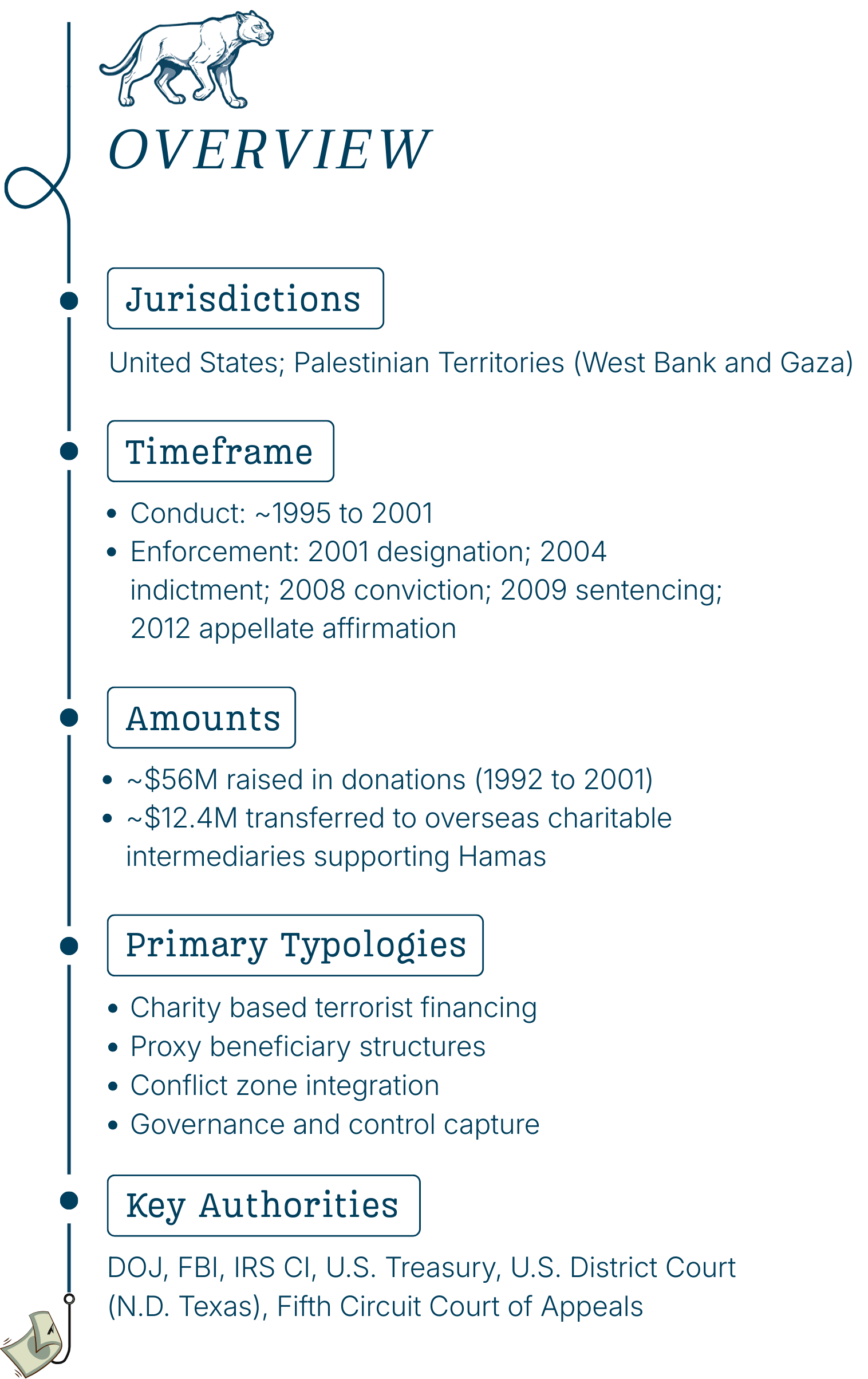

Between the mid-1990s and its designation and shutdown in December 2001, HLF raised millions of dollars in the United States under the guise of humanitarian relief for Palestinians. Prosecutors demonstrated that approximately $12.4 million was funneled to overseas zakat committees that were either Hamas controlled or Hamas aligned, even after Hamas was formally designated under U.S. law.

The legal principle at the heart of the case remains highly relevant for AML and CFT teams today: money is fungible. Funds directed to social welfare, schools, and family assistance can still constitute material support when they strengthen a terrorist organization’s legitimacy, recruitment base, and operational resilience.

HLF matters because it exposes a persistent compliance blind spot: terrorist financing does not always rely on dirty money, false invoices, or clandestine banking. It can flow through legitimate charities, with legitimate documentation and humanitarian spending, while still serving prohibited ends.

This analysis explores:

Who controlled HLF

How the money moved

Why controls failed

What modern institutions should learn