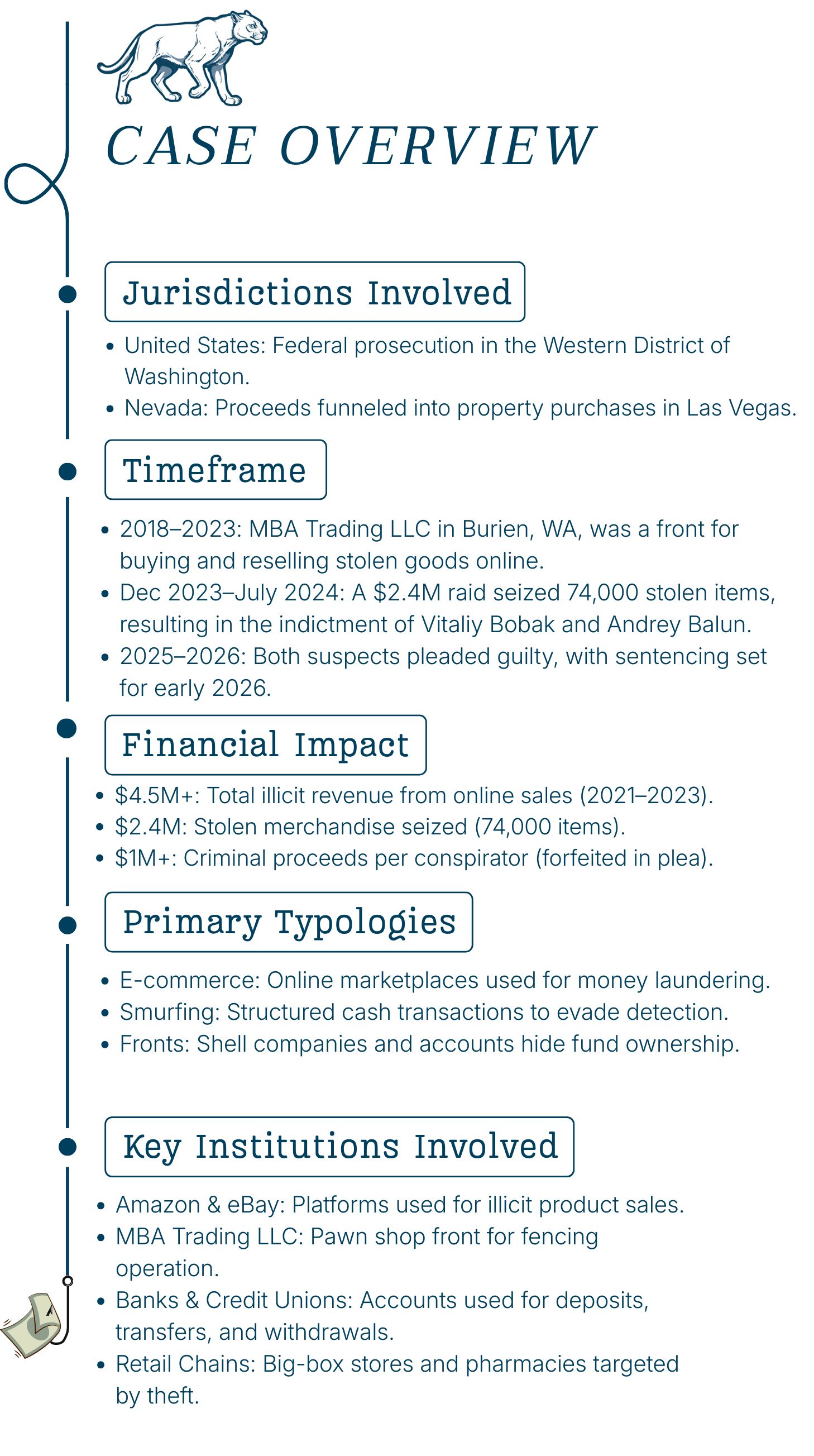

Executive Summary

In December 2023, federal agents raided a small “We Buy Gold & Electronics” shop in suburban Washington State and uncovered a jaw-dropping cache: over 74,000 stolen retail items worth $2.4 million stacked floor-to-ceiling. This unassuming storefront was the epicenter of an audacious scheme that fenced stolen goods through Amazon and eBay, laundering the proceeds through bank accounts and big-ticket purchases. What appeared to be a humble resale business was, in reality, a multi-million-dollar money laundering conspiracy tied to organized retail theft. The case of U.S. v. Bobak & Balun pulls back the curtain on how everyday consumer products can fuel a complex web of criminal profit.

⚬

What Actually Happened

The Setup

Andrey Balun opened a small buy-and-sell shop in Burien, WA, in 2018 under the name MBA Trading LLC. By 2019, he brought his in-law, Vitaliy Bobak, into the business, selling him a 50% stake. The shop quickly became a hub for organized retail theft, buying stolen goods from professional shoplifters (known as “boosters”) at pennies on the dollar. With a steady supply of high-demand merchandise, the duo launched a high-volume online resale operation disguised as a legitimate family business.

The Cover Story

Outwardly, Bobak and Balun ran a typical pawn shop and online store. Their Amazon and eBay profiles, “Medikus” and “abcstore555,” appeared to be legitimate high-volume sellers. They shipped orders promptly, removed security tags, and blended online payments with regular business revenue. The operation was engineered to look like an ordinary resale enterprise.

The Reality

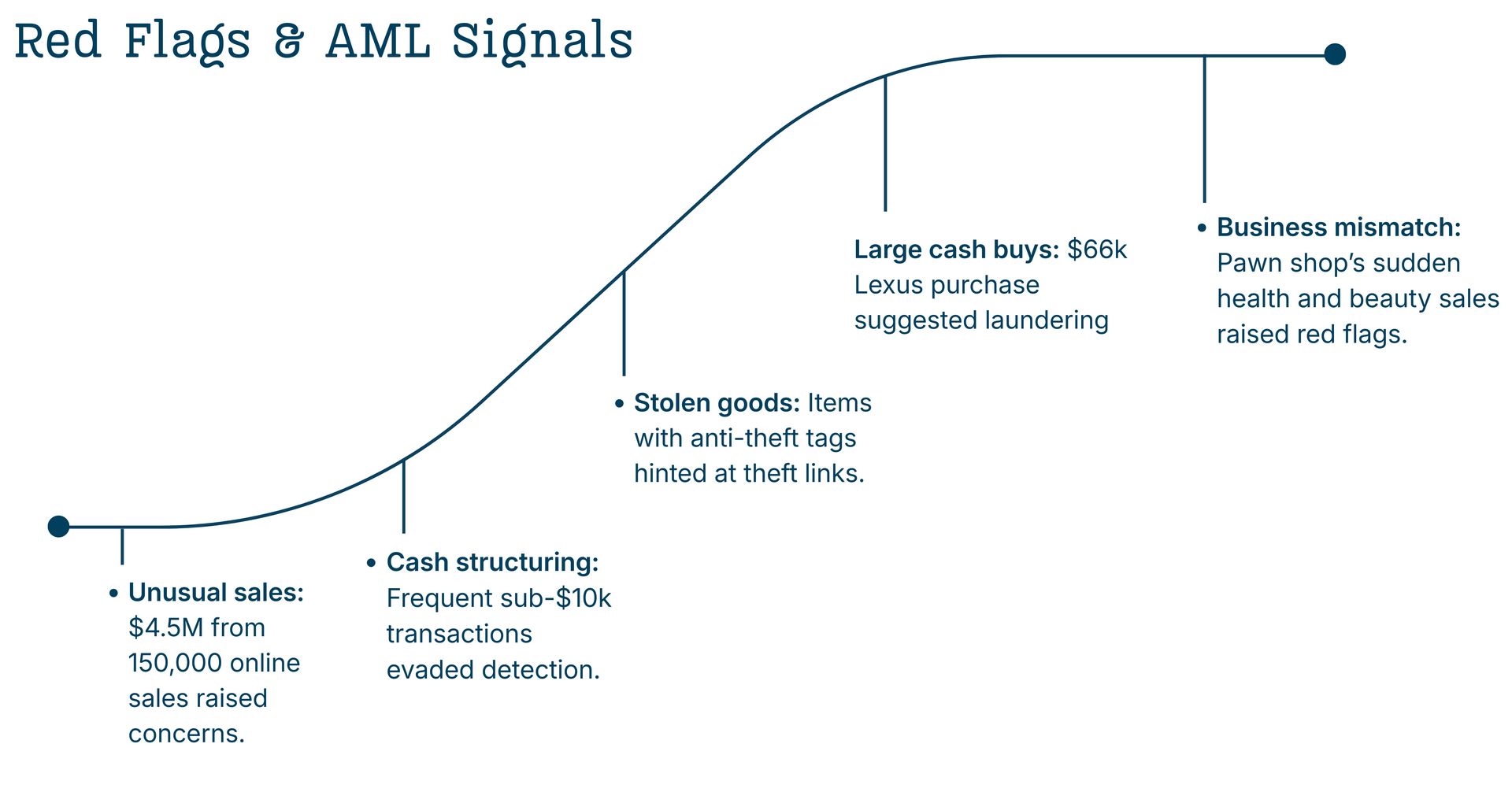

Behind the scenes, the shop was a large-scale fencing and money laundering operation. Boosters delivered stolen goods, often with anti-theft tags still attached. The conspirators paid in cash, stockpiled the items, and resold them online. Between 2021 and 2023, their storefronts processed over 150,000 transactions, generating $4.5M in revenue. The proceeds were funneled into bank accounts, then used for personal luxuries like a $66,000 Lexus and a Las Vegas home.

⚬

How the Scheme Worked

1. Placement

Stolen Goods → Pawn Shop → Online Marketplaces → Banks

Behind the scenes, the shop operated as a major fencing and money laundering hub. Boosters brought in stolen goods, often with anti-theft tags still on. The duo paid in cash, stockpiled the items, and sold them online.

From 2021 to 2023, they processed over 150,000 sales, earning $4.5M, which they funneled into bank accounts and spent on luxuries like a $66,000 Lexus and a Las Vegas home.

2. Layering

Accounts → Transfers → Cash Movements → Paper Justification

To hide the money trail, the duo used layering tactics. They juggled funds between multiple accounts, disguised illicit proceeds as “business expenses” or wages, and withdrew cash in small amounts (a method called smurfing) to avoid detection. These moves concealed the link between their online sales and stolen goods. Even their Las Vegas home purchase was made to appear like a regular real estate deal, masking its criminal origins.

3. Integration

Luxury Assets → Property → Lifestyle Normalisation

In the final stage, Bobak and Balun turned their illegal earnings into personal wealth. Bobak used cash to buy a $66,000 Lexus, while Balun put dirty money into a Las Vegas home down payment. By spending on big-ticket items, they made their criminal profits look legitimate. By the time authorities intervened, each had amassed over $1 million in illicit gains.

⚬

Detection & Discovery

Whistleblowers / Complaints

The scheme began to unravel thanks to retailers and loss prevention teams, not banks or regulators. Major chains noticed stolen products appearing for sale on Amazon and eBay. Investigators shared information on suspicious sellers, alerting law enforcement. Meanwhile, local police received complaints about the Burien pawn shop’s steady flow of people selling high-value items for cash, prompting a deeper investigation.

Regulator / Law Enforcement Detection

The scheme began to fall apart due to the efforts of retailers and loss prevention experts. Major retail chains identified stolen products being sold on Amazon and eBay, prompting investigators to share intelligence on suspicious sellers with law enforcement. At the same time, local police received complaints about the Burien pawn shop’s constant stream of individuals bringing in high-value items for cash, triggering a more in-depth, multi-agency investigation.

SAR/SMR & Internal Alerts

Financial institutions played a key role in identifying irregularities. Banks managing the business’s accounts noticed unusual patterns, such as large payments from online marketplaces paired with frequent cash withdrawals, activity inconsistent with a typical pawn shop. These anomalies likely triggered internal AML alerts and Suspicious Activity Reports (SARs/SMRs) to FinCEN. Additionally, when Bobak purchased a luxury Lexus with $66k in cash, the dealership’s mandatory cash transaction report (Form 8300) flagged a potential illicit source of funds. Combined with law enforcement efforts, these financial red flags helped confirm the money laundering elements of the scheme.

⚬

Regulatory & Legal Fallout

Enforcement Actions

Federal authorities ultimately dismantled the operation. In July 2024, a grand jury indicted Bobak and Balun on 11 criminal counts, including conspiracy to transport stolen property across state lines and conspiracy to commit money laundering. The case highlights the use of money laundering charges (under 18 U.S.C. §§ 1956, 1957) to impose harsher penalties on organized retail crime rings compared to theft alone. Law enforcement seized $2.4 million in stolen merchandise, and both defendants agreed to forfeit $1 million each in illegal proceeds as part of their plea deals. The U.S. Attorney’s Office widely publicized the case, sending a strong message that such crimes will be aggressively prosecuted. Retailers praised the takedown and continue collaborating with authorities on broader initiatives, including new marketplace transparency laws, to prevent similar schemes in the future.

Court Proceedings

Both defendants chose to plead guilty instead of going to trial. Bobak pleaded guilty in September 2025, while Balun, initially set for a February 2026 trial, changed his plea in December 2025. They admitted to the stolen property conspiracy charge, with other charges, including money laundering, set to be dismissed. This reduced their potential prison time significantly—from up to 20 years for laundering charges to a maximum of 5 years for the conspiracy charge. Bobak’s sentencing is set for January 14, 2026, and Balun’s for March 11, 2026. Prosecutors have recommended a 57-month sentence for Balun, though the judge can impose up to the maximum allowed.

Institutional Implications

The Bobak and Balun case had a significant impact on the financial and e-commerce sectors. Platforms like Amazon and eBay are under pressure to improve vetting and monitoring of third-party sellers, as criminals have exploited these sites to launder money. The INFORM Consumers Act now requires more transparency and verification for high-volume sellers to combat anonymous fencing. Banks are also learning from the case, recognizing that small businesses with large, irregular transactions can signal organized crime. The case underscores the need for stricter due diligence on high-cash, high-volume businesses and better collaboration between retailers, online platforms, and bank compliance teams. By spotting these red flags, institutions can avoid facilitating money laundering linked to organized retail theft.

⚬

AML Control Framework

Onboarding & Business Model Controls

Goal: Ensure the business model is credible and sustainable.

Key Actions: Validate declared business activity and scrutinize high-volume marketplace revenue.

Lesson: A pawn shop generating $4.5M+ online without a legitimate supply chain highlights the need for early due diligence.

Cash-Intensive Business Controls

Goal: Detect laundering risks in cash-heavy businesses.

Key Actions: Monitor cash behaviour (e.g., frequent withdrawals) and track structuring patterns over time.

Lesson: Small cash withdrawals obscured links between stolen goods and online sales proceeds.

Transaction Monitoring & Revenue Logic Controls

Goal: Identify revenue that lacks economic credibility.

Key Actions: Compare revenue to business size and costs, and scrutinize rapid inflows disguised as wages or expenses.

Lesson: Illicit funds were hidden as wages and expenses until patterns were reviewed holistically.

Source of Funds / Wealth Triggers

Goal: Spot personal enrichment inconsistent with declared income.

Key Actions: Reassess when luxury purchases or property acquisitions exceed declared profits, and monitor business-to-personal fund transfers.

Lesson: A $66,000 cash Lexus and a home down payment funded by laundered proceeds went unchallenged.

Marketplace-Specific Risk Controls

Goal: Recognize online marketplaces as potential laundering channels.

Key Actions: Flag sellers with high SKU turnover, discounted branded goods, and limited supplier transparency. Use retail theft intelligence.

Lesson: Marketplace legitimacy masked criminal activity, making stolen goods appear as clean sales revenue.

Escalation & Pattern-Based Investigation

Goal: Act when multiple weak signals form a strong pattern.

Key Actions: Escalate investigations when red flags coexist (e.g., inconsistent revenue, heavy cash withdrawals, lifestyle growth). Focus on patterns, not isolated events.

Lesson: Red flags were missed for years due to failure to connect cash behavior, sales scale, and lifestyle spending.

Anchor Principle: Trust economic substance, not platform legitimacy. If a business’s scale does not align with its operations, the revenue may conceal criminal activity.

⚬

Broder Impact

This case brings attention to an emerging problem across the industry: organized retail crime isn't simply minor shoplifting; it's carried out by highly coordinated groups targeting reputable businesses.

The rise of online marketplaces has transformed local theft rings into global operations, compelling law enforcement and policymakers to develop new strategies and enact stronger laws. The consequences of these schemes are wide-ranging. Retailers face multi-million dollar losses, often passed on to consumers through higher prices, while communities experience reduced safety as theft crews grow bolder.

On the other hand, cases like U.S. v. Bobak & Balun demonstrate that authorities are prepared to deploy aggressive anti money laundering tools to dismantle organized theft networks, treating them with the same gravity as traditional financial crimes. The goal is to deter future offenders through successful prosecutions and tighter regulations in both commerce and banking.

However, as long as there is demand for stolen goods, the compliance and law enforcement community must remain vigilant. They will need to adapt to evolving criminal tactics and continue working to cut off the profits that fuel organized retail theft.

⚬

Conclusion

The story of Bobak & Balun is a stark reminder that financial crime can hide in plain sight. What started as an epidemic of retail store theft evolved into a sophisticated laundering scheme that funneled millions through online marketplaces and banks. By thinking outside the box and collaborating across sectors, investigators were able to unravel the scheme and hold its architects accountable.

From my perspective, this case is a wake-up call. It shows us that as AML and compliance professionals, we cannot afford to limit our focus to traditional financial crime. We need to follow the money wherever it leads, whether it is through Amazon storefronts or pawn shops, and rely on our judgment when we identify red flags that others might overlook as anomalies. Criminals are constantly evolving their tactics, and it is our responsibility to remain just as adaptable. The next laundering scheme might take a different form, but the core truth remains the same: every illicit operation leaves a trail, and it is up to us to trace it and prevent criminals from profiting.

⚬

SOURCES & REFERENCES

• U.S. Department of Justice – Bobak & Balun Indictment and Plea Announcements

• U.S. v. Vitaliy Bobak and Andrey Balun (W.D. Wash.)

• Internal Revenue Service – Criminal Investigation (IRS-CI) – Enforcement Releases

• Homeland Security Investigations (HSI) – Organised Retail Theft Enforcement

⚬

Typology Breakdown

Typology | Description | Red Flags | Controls That Failed |

|---|---|---|---|

Online Marketplace Fencing | Stolen retail goods sold on Amazon/eBay, masking criminal proceeds as legitimate e-commerce revenue. | High sales for small sellers; deep discounts on new items with store tags/security labels. | Weak due diligence, unverified provenance, and limited scrutiny of sales spikes. |

Structured Cash Transactions | Repeatedly making small cash withdrawals and deposits to avoid detection and hide money movement. | Frequent cash activity under $10k, multiple branch withdrawals, and cash use not aligning with business model. | Ineffective monitoring and delayed escalation of structuring behavior. |

Front Business & Luxury Integration | Legitimate business used to commingle funds and integrate them through luxury assets and property. | High-value cash purchases; lifestyle not matching income; personal use of business funds. | Inadequate EDD on high-risk small businesses and poor follow-up on large cash purchases and income-spend mismatches. |