🧊 Introduction

Hi there,

Welcome to this week’s edition of Polar Insider. In this issue, we’re diving into a troubling topic: how nonprofit organizations and charities, often trusted pillars of society, can be exploited by criminals to launder money or finance terrorism. While these organizations are designed to do good, some have been misused as convenient fronts for illicit activities. This issue is especially relevant for compliance officers working with NGOs, faith-based charities, or cross-border remittances.

Here’s what’s inside this issue:

📌 Top Story – Charity or Cover-Up? How Criminals Launder Dirty Money Through NGOs🔎 Case Study – Holy Land Foundation (U.S.)🌍 Regulatory Roundup🧰 Compliance Toolkit – FATF Rec 8 guidance, ACNC charity risk guide💬 Quote of the Week

📌 Top Story

Charity or Cover-Up? How Criminals Launder Dirty Money Through NGOs

Non-governmental organizations (NGOs) and charities are designed to serve the public good, but their trusted status, tax exemptions, and cross-border operations make them attractive targets for criminals. These bad actors exploit NGOs to conceal the origins or destinations of dirty money.

Common Laundering Typologies

Fake or Shell Charities – Sham NGOs that exist only on paper.

Imposter Charities – Scams posing as legitimate organizations.

Insider Misuse – Infiltration of genuine charities to divert funds.

Commingling Illicit Funds – Injecting dirty money as donations.

Overvalued or Fictitious Donations – Inflating or inventing gifts for laundering and tax abuse.

Complex Layering – Using multiple projects/accounts to hide trails.

Cross-Border “Aid” Transfers – Abusing international flows.

Cash-Heavy Fundraising – Mixing illicit cash with genuine donations.

The Risk to Financial Institutions

Charities’ reputations and complex operations can mask suspicious flows, posing compliance and reputational risks. Sham NGOs with paperwork and disguised transfers can slip through standard due diligence.

Mitigation Strategies

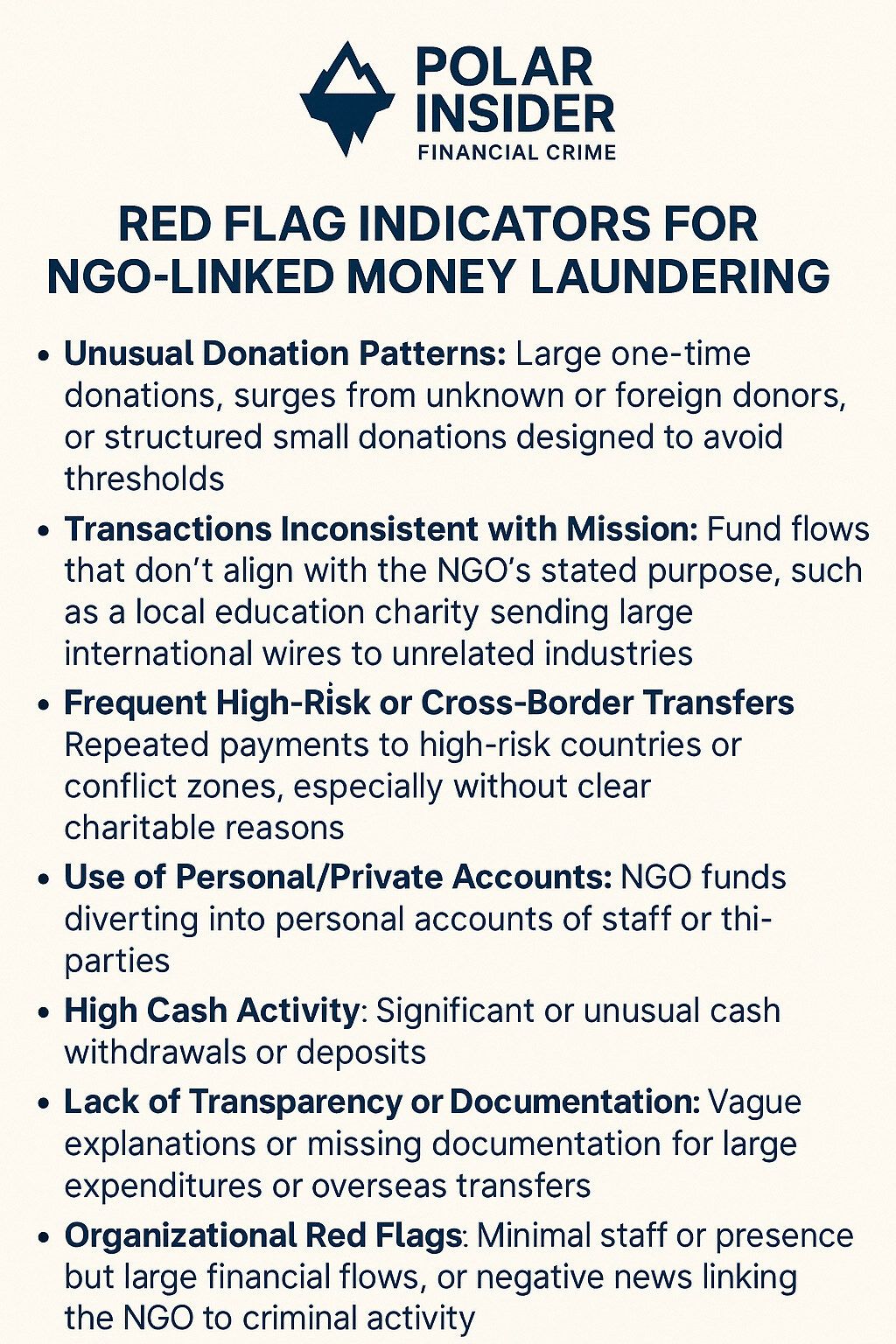

✅ Risk-Based Due Diligence – Verify NGO legitimacy, registration, and principals.✅ Monitor Donation Patterns – Establish baselines to flag anomalies.✅ Automated Alerts – Configure systems for cash surges or high-risk transfers.✅ Supporting Documentation – Require invoices, project details, or beneficiary data.

🧠 Pro Tip: Don’t assume charitable status means low risk. Revisit NGO profiles regularly.

🔎 Case Study

Holy Land Foundation (U.S.)

The Holy Land Foundation (HLF), once the largest Muslim charity in the U.S., was shut down in 2001 after authorities discovered it funneled $12 million in donations to Hamas under the guise of humanitarian aid. In 2008, five HLF leaders were convicted in the largest terrorism financing prosecution in U.S. history.

Step by Step

Pretext: HLF presented itself as a relief charity for Palestinians.

Execution: Funds were diverted to Hamas-controlled committees disguised as aid.

Discovery: Post-9/11 investigations revealed $12m in diverted funds.

Aftermath: Leaders received 15–65 year prison sentences.

Key Lessons for Compliance Teams

🚨 Even “good” charities can hide crime – verify fund flows.🔐 Follow the end use of funds – screen partner organizations.🧱 Consequences are severe – long prison terms and reputational fallout.

Additional Examples

Fake Charity Network (U.S.): 76 sham NGOs, including a fake “American Cancer Society of Michigan,” created for laundering and tax evasion.

Chabad UK (U.K.): Real charity used to launder over £10m, diverting donations and processing counterfeit goods.

🌍 Regulatory Roundup

🇺🇸 North America: OFAC (June 2025) sanctioned 5 individuals and 5 NGOs diverting funds to Hamas and PFLP. Canada and the U.S. also jointly targeted Vancouver-based Samidoun, exposed as a militant front.

🇪🇺 Europe: FATF updated standards on Recommendation 8 (2023) to protect charities from terrorist financing. The EU’s 2024 AML package requires crowdfunding platforms to conduct AML checks. Belgian prosecutors reopened a case involving a nonprofit art foundation linked to oligarch Oleg Deripaska.

🇦🇺 Asia-Pacific: AUSTRAC and ACNC warned of extremist infiltration of Australian charities. Several NGOs are under investigation for terror links. AUSTRAC highlighted vulnerabilities like poor due diligence and cash reliance.

Key Message: Regulators worldwide demand stronger controls for charities. NGOs remain high-risk customers requiring enhanced scrutiny.

🧰 Compliance Toolkit

FATF Best Practices on Combating Abuse of NPOs (2023) – Guidance on protecting charities from terrorist financing abuse.📎 Link → FATF Best Practices

ACNC Guide – Protecting Your Charity from Terrorism Financing – Practical advice for charities on mitigating terrorism financing risks.📎 Link → ACNC Guidance

💬 Quote of the Week

“Organizations like Samidoun masquerade as charitable actors that claim to provide humanitarian support to those in need, yet in reality divert funds to support terrorist groups.” – Bradley T. Smith, Acting Under Secretary for Terrorism and Financial Intelligence, U.S. Treasury

🎁 Bonus for Subscribers

Don’t forget to download your copy of the 2025 Financial Crime Regulatory Tracker (USA, UK, AU). Stay on top of AML requirements and enforcement trends globally.