🧊 Introduction

Hi there,

Welcome to this week’s edition of Polar Insider! In this issue, we dive into “The Grey Zone: When Does a PEP Stop Being a PEP?”. A complex dilemma surrounding the declassification of Politically Exposed Persons (PEPs) in compliance programs.

Here’s what’s inside:

📌 Top Story – The Grey Zone: When Does a PEP Stop Being a PEP?

🔎 Case Study – Nigel Farage Debanking Controversy

🌍 Regulatory Roundup – Updates from North America, Europe, and Asia-Pacific

🧰 Compliance Toolkit – Essential resources for PEP guidance

💬 Quote of the Week – Balancing scrutiny and fairness for PEPs

📌 Top Story

The Grey Zone: When Does a PEP Stop Being a PEP?

🎥 Prefer to watch? Catch the 45-sec explainer:

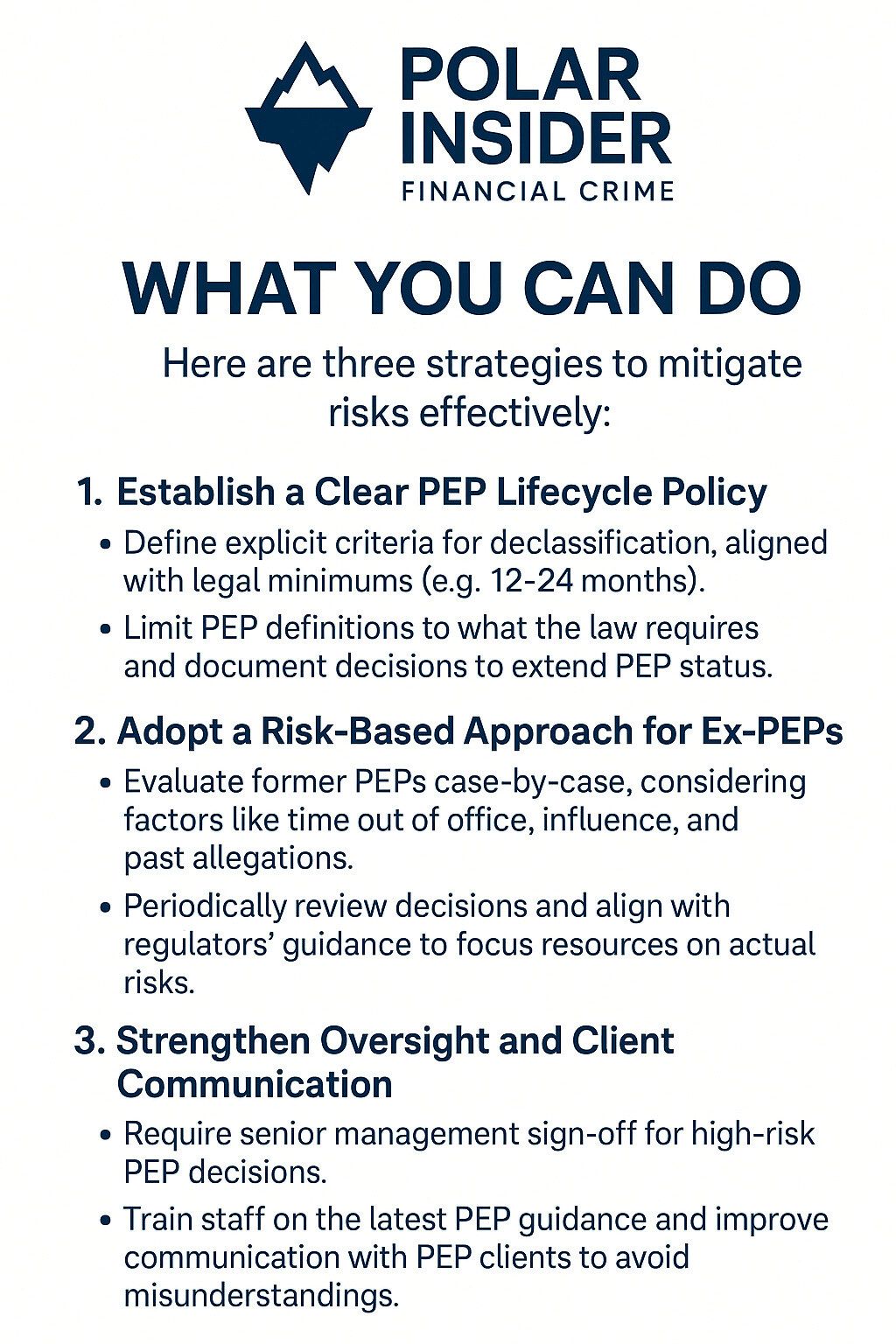

When a Politically Exposed Person leaves office, at what point can they be treated as an ordinary customer again? Divergent rules across jurisdictions and unclear endpoints create a compliance conundrum.

What’s Happening

Financial institutions worldwide grapple with the PEP declassification dilemma. While global standards like FATF Recommendation 12 mandate enhanced due diligence for current and former officials, there’s no universal rule for how long someone remains a PEP after leaving office.

Timeframes vary: Most jurisdictions set arbitrary periods (12–18 months) for declassification, but some, like the EU, are extending this to 24 months to harmonize practices.

Conservative approaches prevail: Many banks adopt a “once a PEP, always a PEP” stance to avoid regulatory backlash, even if it contradicts risk-based principles.

Inconsistent definitions: U.S. regulators focus on foreign political figures, while the UK includes domestic PEPs but now classifies them as lower risk by default.

This lack of clarity leaves compliance teams in a grey zone, unsure when it’s safe to “graduate” a client from PEP status.

The Risk to Financial Institutions

Navigating this grey zone is fraught with risks:

Declassify too early: You might miss red flags, as former officials can still wield influence or move illicit funds.

Keep PEP status indefinitely: This can strain client relationships, create unnecessary burdens, and lead to public controversies, as seen in the UK’s 2023 debanking furor involving Nigel Farage.

🧠 Pro Tip: Don’t let “once a PEP, always a PEP” become an unexamined rule. Regulators emphasize that PEP status should be guided by ongoing risk, not default assumptions.

🔎 Case Study

Nigel Farage Debanking Controversy

Coutts Bank in London became the center of a debanking scandal after closing Nigel Farage’s accounts, citing reputational risks.

Nigel Farage, a former Member of the European Parliament (1999–2020), is best known for leading UKIP and the Brexit Party, playing a pivotal role in the UK’s decision to leave the EU.

Summary

In 2023, Coutts closed Farage’s accounts, initially citing financial criteria. However, internal documents revealed the decision was influenced by his PEP status and controversial public profile.

What Happened

Pretext: Farage’s accounts were closed due to falling below Coutts’ wealth threshold (~£1M).

Internal Rationale: A leaked dossier showed Coutts maintained his PEP status due to his public influence and perceived reputational risks.

Aftermath: The controversy sparked a media firestorm, leading to the resignation of NatWest’s CEO and regulatory reviews into PEP handling.

Key Lessons

Document Clear Rationale: Ensure decisions are defensible and tied to specific risk criteria.

Apply Proportionate Risk Treatment: Treat low-risk PEPs accordingly to avoid unnecessary exits.

Prioritize Communication: Develop protocols for transparent communication with PEP clients to prevent misunderstandings.

🌍 Regulatory Roundup

🇺🇸 North America

U.S.: FinCEN emphasizes a risk-based approach, clarifying that not all PEPs are high risk.

Canada: FINTRAC expands PEP monitoring rules and enforces penalties for compliance failures.

🇪🇺 Europe

UK: FCA guidance (2024) urges firms to classify domestic PEPs as lower risk and promptly review PEP status post-office.

EU: Upcoming AML regulations will standardize PEP handling across member states, extending monitoring periods to 24 months.

🇦🇺 Asia-Pacific

Australia: AUSTRAC’s revised rules require senior management approval for PEP relationships.

Singapore: MAS emphasizes proportionality in PEP treatment, with strict EDD for high-risk foreign PEPs.

🧰 Compliance Toolkit

Equip yourself with these resources:

FATF Guidance on PEPs – Official guidelines on enhanced measures for PEPs.

FinCEN Joint Statement – Clarifies that PEP due diligence should be risk-driven.

FCA Final Guidance FG25/3 – UK-specific guidance on managing PEPs proportionately.

💬 Quote of the Week

“Public service naturally comes with greater scrutiny. But it must be proportionate and shouldn’t disadvantage people running for office or taking senior public roles, or their families… That requires a balancing act.”– Sarah Pritchard, Executive Director, UK Financial Conduct Authority

🎁 Bonus for Subscribers

Don’t forget to download your copy of the 2025 Financial Crime Regulatory Tracker (USA, UK, AU). Stay on top of AML requirements and enforcement trends globally.