🧊 Introduction

Hello there,Welcome to this week’s edition of Polar Insider! In this issue, we’re diving into a critical topic: Trusts as the Ultimate Money Laundering Vehicle. We’ll explore how opaque trust structures enable illicit fund flows and, more importantly, what can be done to counteract this growing risk.

Here’s what’s inside:

📌 Top Story – The Black Box of Beneficial Ownership

🔎 Case Study – Oligarch’s Trust Shuffle Exposed

🌍 Regulatory Roundup

🧰 Compliance Toolkit – Practical resources, including FATF guidance, investigative tools, and tips to unmask risky trusts.

📌 Top Story: The Black Box of Beneficial Ownership

Trusts: The Ultimate Money Laundering Vehicle

🎥 Prefer to watch? Catch the 1:45min explainer:

Trusts, especially discretionary, offshore, and multi layered ones, are under scrutiny as powerful enablers of financial crime. This section unpacks how illicit actors exploit trusts to hide beneficial ownership, why regulators are raising alarms, and what you can do to reduce the risks.

What’s Happening

Trusts are legal arrangements where a settlor transfers assets to a trustee to manage for beneficiaries. While they serve legitimate purposes like estate planning, they are increasingly misused to obscure ownership and launder funds. Criminals can place assets - cash, real estate, companies, yachts - into trusts, creating a nearly impenetrable layer of secrecy. Discretionary trusts, in particular, complicate matters by not naming fixed beneficiaries, leaving trustees with broad discretion.

The scale is staggering:

The Pandora Papers revealed 200+ U.S. trusts holding over $1 billion, with nearly 30 linked to individuals accused of fraud, bribery, or human rights abuses.

In the UK, 236,500+ properties worth at least £64 billion are hidden behind trusts.

Globally, $1 trillion in oligarch wealth remains largely untouched by sanctions, shielded by anonymous trusts.

The Risk to Financial Institutions and Firms

For financial institutions, trusts pose unique AML challenges. They can mask the involvement of high-risk individuals, such as politically exposed persons (PEPs) or sanctioned individuals, by listing only the trustee in account records. Criminals often use professional enablers - lawyers, accountants, and trust service providers - to set up elaborate trust networks, frustrating investigative efforts.

Trusts are not limited to private banking; they appear in real estate deals, commercial transactions, and even online gambling payouts. Without robust controls, institutions risk unwittingly facilitating money laundering or sanctions evasion, with severe regulatory and reputational consequences.

What You Can Do

Here are four strategies to manage trust risk:

✅ Know Your Trust (KYTrust) – Identify all parties: settlors, trustees, protectors, beneficiaries, and anyone with control. Request trust deeds and registration documents. Refusal to disclose = red flag.

✅ Enhance Due Diligence & Monitoring – Categorize trust clients as high-risk. Verify sources of funds/wealth. Monitor for sudden beneficiary changes, complex layering, or cross-border transfers inconsistent with the trust’s purpose.

✅ Scrutinize Gatekeepers – Assess lawyers, accountants, and trust companies. If they’re lightly regulated or in secrecy havens, treat as a red flag. Include gatekeeper risk in client acceptance and periodic reviews.

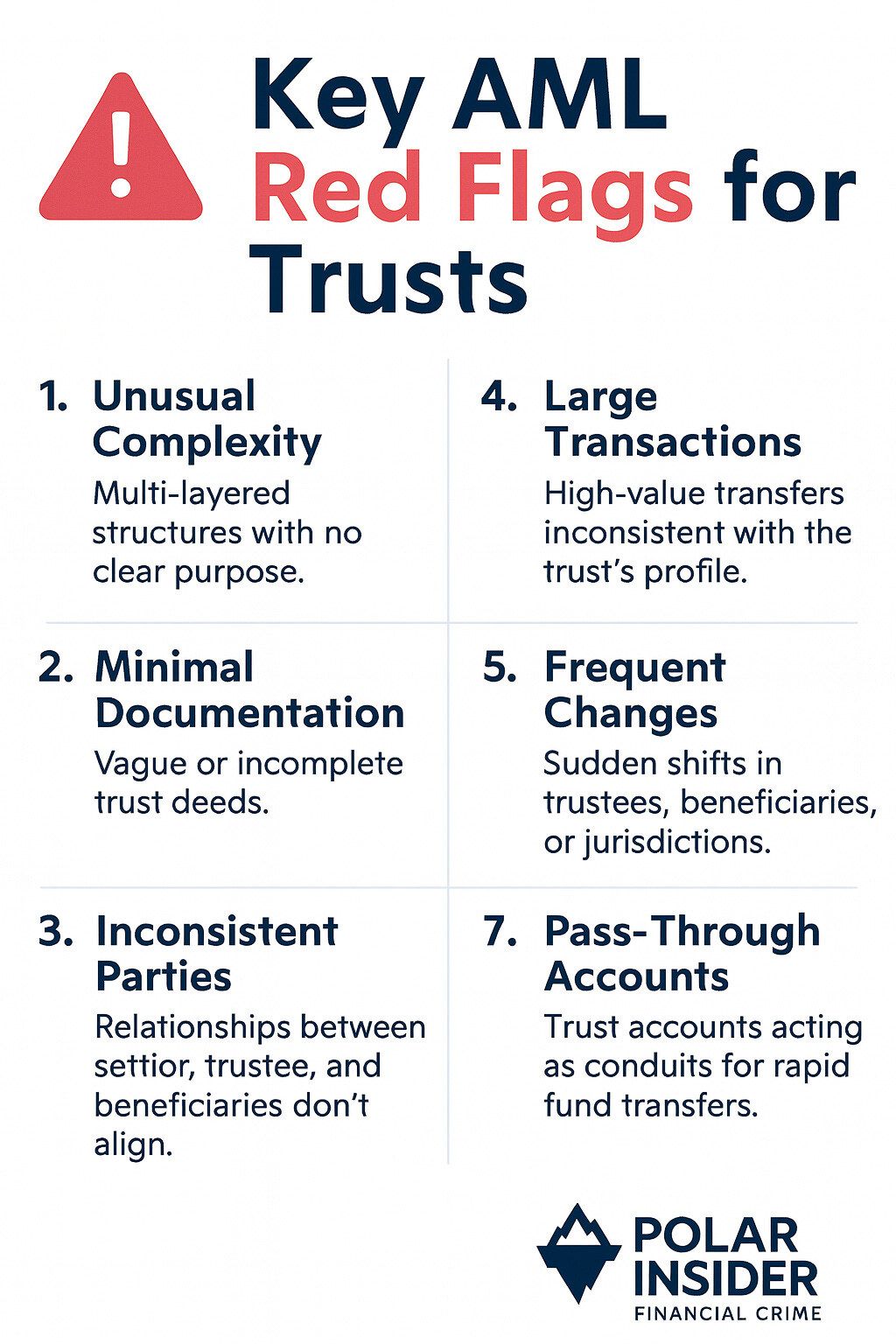

✅ Visual Tools – Use infographics and checklists to train staff. A quick-reference diagram of trust structures and AML red flags can prevent oversights.

🧠 Pro Tip: Trust but verify. Every trust should be treated as a potential black box — your job is to open it. If the trust’s purpose or beneficiaries are unclear, escalate and reconsider the relationship.

🔎 Case Study: Oligarch’s Trust Shuffle Exposed

Roman Abramovich’s Billion Dollar Trust Maneuver

This case study illustrates how Russian oligarch Roman Abramovich used trusts to shield his wealth from sanctions. Facing impending sanctions in early 2022, Abramovich rapidly reorganized offshore trusts holding billions in assets, shifting beneficial ownership to his children.

What Happened

In February 2022, Abramovich amended at least 10 offshore trusts, adding his children as beneficiaries and reducing his own interest. This maneuver effectively transferred ownership of luxury assets like yachts and real estate to minors, complicating enforcement when sanctions were imposed weeks later.

Key Lessons for AML Teams

🚨 Sudden Ownership Changes = Red FlagMonitor for last-minute amendments involving relatives of high-risk individuals, especially around external events (e.g. sanctions, lawsuits).

🔐 Trust Secrecy Enables EvasionComplex trusts are not neutral estate planning — they may be designed to shield assets. Always look through to ultimate controllers and associates.

🧱 Expand SurveillanceUse OSINT (e.g. ICIJ Offshore Leaks) to detect client links to trusts in leaks. Update monitoring rules: e.g. generate alerts when major assets are sold or transferred soon after trust amendments.

🌍 Regulatory Roundup

🇺🇸 North America

US: Authorities are cracking down on trust secrecy, with new investigations into domestic trusts used by Russian oligarchs.

Canada: New rules require annual reporting of beneficial ownership for most trusts, closing key transparency gaps.

🇬🇧 Europe

UK: The Trust Registration Service now mandates registration of all express trusts, but enforcement challenges remain.

EU: A court ruling limited public access to beneficial ownership registries, but reforms are underway to address this setback.

🇸🇬 Asia Pacific

Singapore: Expanded AML rules now require detailed reporting on all trust parties, including protectors and discretionary beneficiaries.

Australia: New legislation extends AML obligations to lawyers and trust service providers, closing a long-standing loophole.Key Message: Around the globe, the trend is toward greater transparency and gatekeeper accountability. Institutions must be ready to verify trust parties and decline opaque structures.

🧰 Compliance Toolkit

Equip your team with these resources:

FATF Guidance on Beneficial Ownership: Practical advice on trust transparency and risk assessment.

Open Ownership Briefing: Insights into why trusts are attractive to criminals and how to close policy gaps.

ICIJ Offshore Leaks Database: A searchable tool to identify trust related red flags from major leaks.

📎 Link → ICIJ Offshore Leaks Database

💬 Quote of the Week

“The beneficial ownership registry concept will only be credible if it also includes legal arrangements such as trusts. Limiting it to companies only is window dressing at best.”— Daniel Thelesklaf, Director of Liechtenstein’s Financial Intelligence Unit

🎁 Bonus for Subscribers

Don’t forget to download your copy of the 2025 Financial Crime Regulatory Tracker (USA, UK, AU). Stay on top of AML requirements and enforcement trends globally.