🧊 Introduction

Hi there,Welcome to this week’s edition of Polar Insider. In this issue, we dive into why the British Virgin Islands (BVI) is often regarded as the top jurisdiction for laundering money through shell companies and what compliance teams can do to mitigate the risks.

Here’s what you’ll find inside:📌 Top Story – The Shell Company Capital🔎 Case Study – Putin’s Friend & the $2 Billion Shell Game🌍 Regulatory Roundup – BVI on the FATF grey list and global transparency reforms🧰 Compliance Toolkit – Practical resources to detect and de-risk offshore companies

📌 Top Story – The Shell Company Capital

Why the British Virgin Islands Tops Global Laundering Networks

The British Virgin Islands, a UK overseas territory with a population of just 30,000, has become synonymous with corporate secrecy. For decades, its lenient regulations and streamlined company-formation process have attracted both legitimate investors and illicit actors seeking anonymity.

What’s Happening

BVI is home to over 370,000 registered companies - roughly ten companies for every resident. Companies can be formed within days through local agents, and crucially, the beneficial owners are not publicly disclosed. Leaked data from the Panama Papers, FinCEN Files, and Pandora Papers reveal that BVI entities dominate global shell-company networks, appearing in nearly half of all offshore structures tied to corruption or laundering.

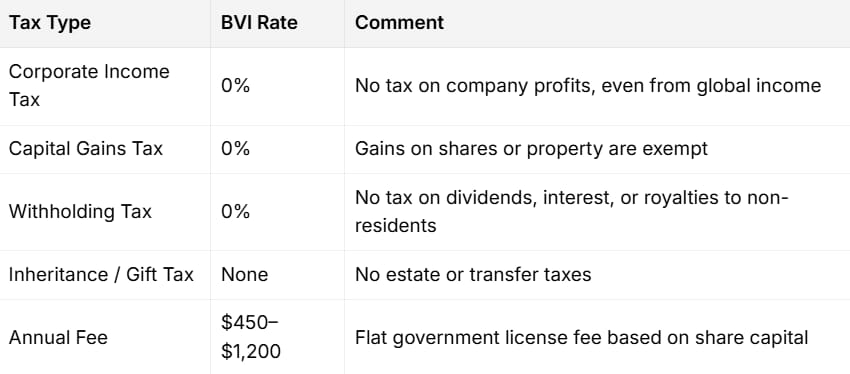

🏝 The Tax Advantage: Zero Corporate Burden

BVI’s economic model is built on no taxes and low fees rather than transparency.

There are also no financial statement filing or audit requirements for most companies. Legitimate investors use this to cut red tape; criminals use it to wash or park illicit wealth without scrutiny.

Why It Matters

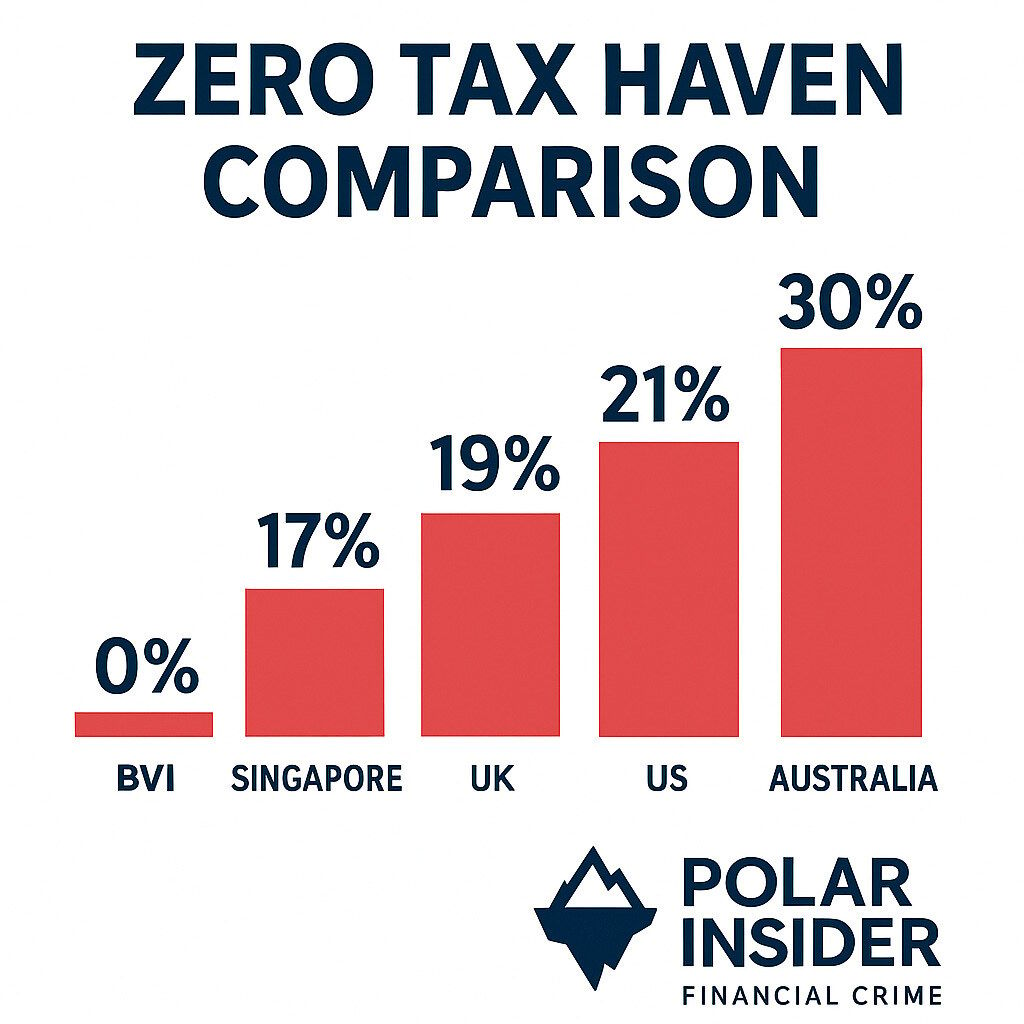

The combination of zero tax, anonymity, and ease of access creates the perfect recipe for shell companies. BVI entities often serve as the first layer in global laundering chains, obscuring the true owner before funds flow into major financial hubs like London, New York, or Hong Kong.

The Risk to Institutions

Any customer, transaction, or counterparty involving a BVI company should trigger enhanced due diligence. BVI shell companies are frequently used for:

Laundering proceeds of corruption and fraud

Sanctions evasion

Asset-shielding for politically exposed persons (PEPs)

Banks and fintechs that fail to investigate ownership structures risk facilitating illicit flows and facing regulatory penalties.

What You Can Do

✅ Look Through Every Entity. Obtain verified ultimate beneficial owner (UBO) data for any BVI customer. Refusal = red flag.✅ Verify Source of Funds. Require supporting evidence for incoming or outgoing transfers tied to offshore entities.✅ Assess the Gatekeepers. Conduct due diligence on lawyers, accountants, or service providers who form or manage BVI companies.✅ Use Open Data. Search databases like ICIJ Offshore Leaks or OpenCorporates for matching names or addresses.

🧠 Pro Tip: When you see “BVI Ltd.” in ownership paperwork, pause. The cost of deeper checks is small; the cost of missing a hidden owner can be huge.

🔎 Case Study – Putin’s Friend & the $2 Billion Shell Game

Sergei Roldugin and the BVI Network of Hidden Wealth

The Panama Papers revealed that Sergei Roldugin, a Russian cellist and close friend of President Putin, controlled a network of BVI-registered companies that moved over $2 billion through opaque “loans” and asset swaps.

While Roldugin appeared as the legal owner, leaked emails showed he acted as a proxy for Putin’s inner circle. The BVI shell companies acquired stakes in strategic Russian firms and laundered state-linked funds through fake trades and sweetheart loans.

When journalists exposed the network in 2016, banks faced criticism for failing to question why a classical musician was moving vast sums via offshore vehicles. This case became a prime example of how BVI anonymity combined with global banking access creates the perfect cover for kleptocrats.

Lessons for AML Teams:🚨 Profile Mismatch = Red Flag. Low-income or low-visibility clients handling large flows via BVI entities deserve immediate review.🔐 Watch PEP Proxies. Relatives and associates of high-risk PEPs can act as fronts.🧱 Leverage Leaks. Check client names in ICIJ databases and adverse-media feeds to spot offshore links early.

🌍 Regulatory Roundup

🇻🇬 BVI – FATF Grey ListIn June 2025 the FATF placed BVI on its “Jurisdictions Under Increased Monitoring” list for failing to tighten beneficial-ownership rules. Banks must now apply enhanced due diligence to BVI-linked transactions until reforms take effect.

🇺🇸 United States – Corporate Transparency Act DelaysImplementation of the CTA has been paused after legal challenges. US companies may not need to file beneficial-owner data until late 2025, creating a temporary loophole for shells to move through Delaware and Nevada.

🇪🇺 Europe – AMLD6 Restores AccessThe EU’s 6th Anti-Money Laundering Directive (2024) re-opens beneficial-ownership data to journalists and civil-society groups with a “legitimate interest” and establishes a new EU AML Authority to coordinate enforcement.

🇸🇬 Singapore – Trust and Corporate Reporting TightenedIn 2024, MAS expanded AML reporting for trusts and company service providers, aligning with FATF’s new transparency standards. Firms must now collect and maintain detailed data on all beneficial owners, trustees, and controllers.

Key Message: Transparency is closing in on offshore centers, but the world’s biggest haven still operates on a 0% tax rate and a culture of confidentiality. Institutions must fill the gap with enhanced screening and open-source intelligence.

🧰 Compliance Toolkit

FATF Best Practices on Beneficial Ownership (2023) – Guidelines to prevent misuse of legal persons.📎 Link Guidance on Beneficial Ownership and Transparency of Legal Arrangements

ICIJ Offshore Leaks Database – Searchable records from Panama & Paradise Papers to identify hidden entities.📎 Link ICIJ Offshore Leaks Database

OpenCorporates – Global registry aggregator covering 140 jurisdictions for director and company data.📎 Link OpenCorporates

💬 Quote of the Week

“It is clear that an economy based on secrecy and low taxes is a recipe for bad governance, corruption, and criminality.”— Margaret Hodge, U.K. Member of Parliament

🎁 Bonus for SubscribersDownload the 2025 Financial Crime Regulatory Tracker (USA | UK | AU) to stay ahead of beneficial-ownership and AML reform deadlines.