🧊 Introduction

Hi there,

Welcome to this week’s edition of Polar Insider. This issue explores how criminals exploit YouTube donations and livestream monetization to launder illicit funds.

Here’s what you’ll find inside this issue:

📌 Top Story – Laundering via YouTube Donations🔎 Case Study – Turkey’s $10M Twitch Laundering Ring🌍 Regulatory Roundup🧰 Compliance Toolkit – Resources on Creator Monetization Risks

📌 Top Story

Laundering via YouTube Donations

🎥 Prefer to watch? Catch the 2 min explainer:

Criminals have turned YouTube’s monetization tools into an unlikely laundering mechanism. Using Super Chats, channel memberships, and linked donation platforms (PayPal, Patreon, even crypto wallets), illicit funds can be disguised as “viewer support.” Google then pays out these amounts as legitimate creator revenue – giving dirty money a clean exit.

What’s Happening

Placement: Fraudsters channel illicit funds via small donations.

Layering: Stolen credit cards or prepaid debit cards make numerous microtransactions.

Integration: Google AdSense payouts look like legitimate content income.

Why it works:

Legitimacy: Payments originate from Google.

Low Visibility: Small donations avoid AML thresholds.

Global Reach: 95+ countries eligible for monetization.

Crypto Crossover: Direct wallet donations add another layer of anonymity.

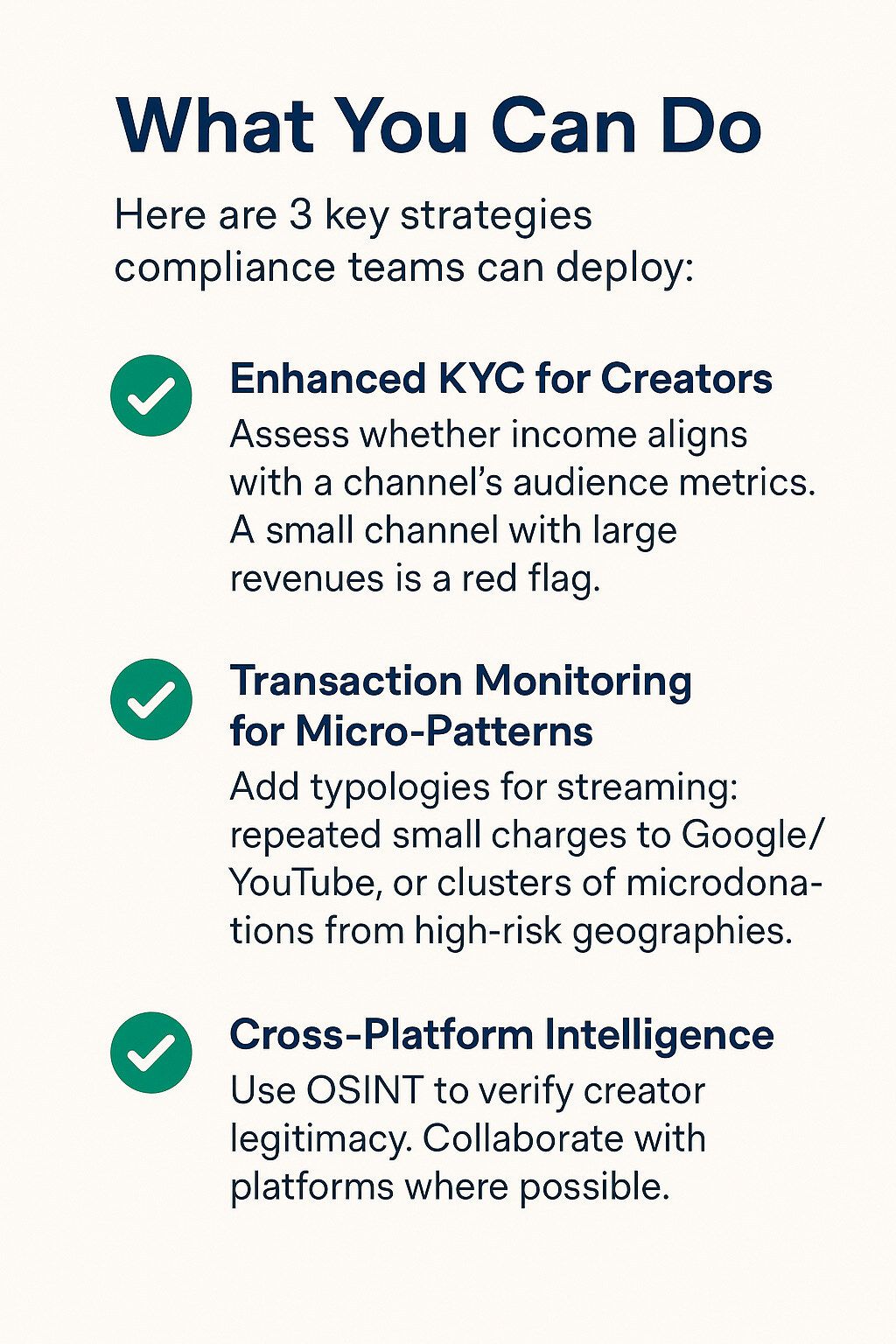

The Risk to Financial Institutions

Banks see payouts labelled as “Google AdSense” or “YouTube,” often without context. Risks include:

Mismatch between revenue and channel size – high income despite low views/subscribers.

Clustering of microtransactions from diverse geographies.

Chargebacks from stolen card use.

🧠 Pro Tip: Watch out for “straw channels” – small creators who agree to act as laundering conduits in exchange for a cut.

🔎 Case Study

Turkey’s $10M Twitch Laundering Ring

SummaryBetween 2020–2021, a fraud network laundered nearly $10 million through Twitch. Stolen credit cards were used to buy Twitch’s in-app currency (Bits), which were donated to small streamers. Twitch then paid the streamers, who returned most of the funds to criminals – keeping a commission.

What Happened

Pretext: Criminals approached streamers with promises of easy donations.

Execution: Fraudsters bought Bits with stolen cards → donated to streamers → Twitch payouts looked legitimate → streamers returned 70–80% to organizers.

Discovery & Aftermath:A 2021 Twitch data leak exposed disproportionate streamer earnings. Turkish authorities arrested 40 suspects across 11 provinces. The scandal showed how criminals exploit livestream economies, and how small streamers can be drawn in as “fronts.”

Key Lessons for Financial Crime Teams

🚨 Donation-to-Viewer Ratio CheckMicro channels with outsized income signal laundering.

🔐 OSINT as Early WarningCommunity forums and leaks flagged anomalies before regulators did.

🧱 Cross-Border SchemesStolen cards abroad, laundered via a U.S. platform, in Turkey – global typology, requiring international cooperation.

🌍 Regulatory Roundup

🇺🇸 North America

OFAC Sanctions Narco-YouTuber – U.S. Treasury sanctioned Mexican rapper El Makabelico, who funnelled music royalties and YouTube revenue to a cartel.

Corporate Transparency Act – FinCEN extended the BOI reporting deadline: existing companies must report beneficial owners by April 2025.

🇪🇺 Europe

EBA Warning on Digital Laundering – Supervisors report “high and rising” AML risks in fintech, crypto, and streaming platforms.

AMLA Preparations – The new EU AML Authority (launching 2026) will directly supervise cross-border institutions and crypto providers.

🇸🇬 Asia-Pacific

Scam Command Centers – Singapore, Malaysia, and the Philippines launch joint anti-scam hubs to combat digital fraud.

🇦🇺 Australia’s Tranche 2 AML Reforms – Lawyers, accountants, and real estate agents must enroll with AUSTRAC by March 2026.

Key Message: Regulators worldwide are converging on digital economy risks. Streaming platforms are no longer “blind spots” – compliance officers must treat creator incomes as potential laundering vectors.

🧰 Compliance Toolkit

Equip yourself with these resources to tackle financial crime in creator monetization:

• FATF – Crowdfunding for Terrorist Financing (2023) - Global typology guidance on how terrorists exploit online donations.📎 Link → Crowdfunding for Terrorism Financing

• ISD – Cash for Comments: How YouTube’s Super Chats Feature Is Misused (2022) - A detailed study exposing how extremist content can be monetized via Super Chats, including case studies and platform moderation gaps.📎 Link → Cash-for-Comments.pdf

• Policy Alert – K2 Integrity’s Summary of FATF Crowdfunding Report - A concise briefing on the FATF’s findings on crowdfunding abuse for terrorism financing—fresh insights for busy professionals.📎 Link → Terrorist Use Of

💬 Quote of the Week

“The idea that multiple hate groups could raise tens of thousands of dollars a month from bleeding-edge technology and a tiny donor pool should be terrifying, not ho-hum.”— Megan Squire, Senior Fellow, SPLC

🎁 Bonus for Subscribers

Don’t forget to download your copy of the 2025 Financial Crime Regulatory Tracker (USA, UK, AU).

Stay on top of AML requirements and enforcement trends globally.