A once-ordinary real estate investor became the architect of a $165 million fraud that shook commercial mortgage markets. Through inflated property deals and a cast of co-conspirators, Boruch “Barry” Drillman pulled off one of the largest flip-based mortgage frauds in recent U.S. history.

The scheme unraveled when Drillman, facing mounting pressure and fearing prosecution, flipped - recording a key conversation that brought his own network to justice.

⚬

Executive Summary

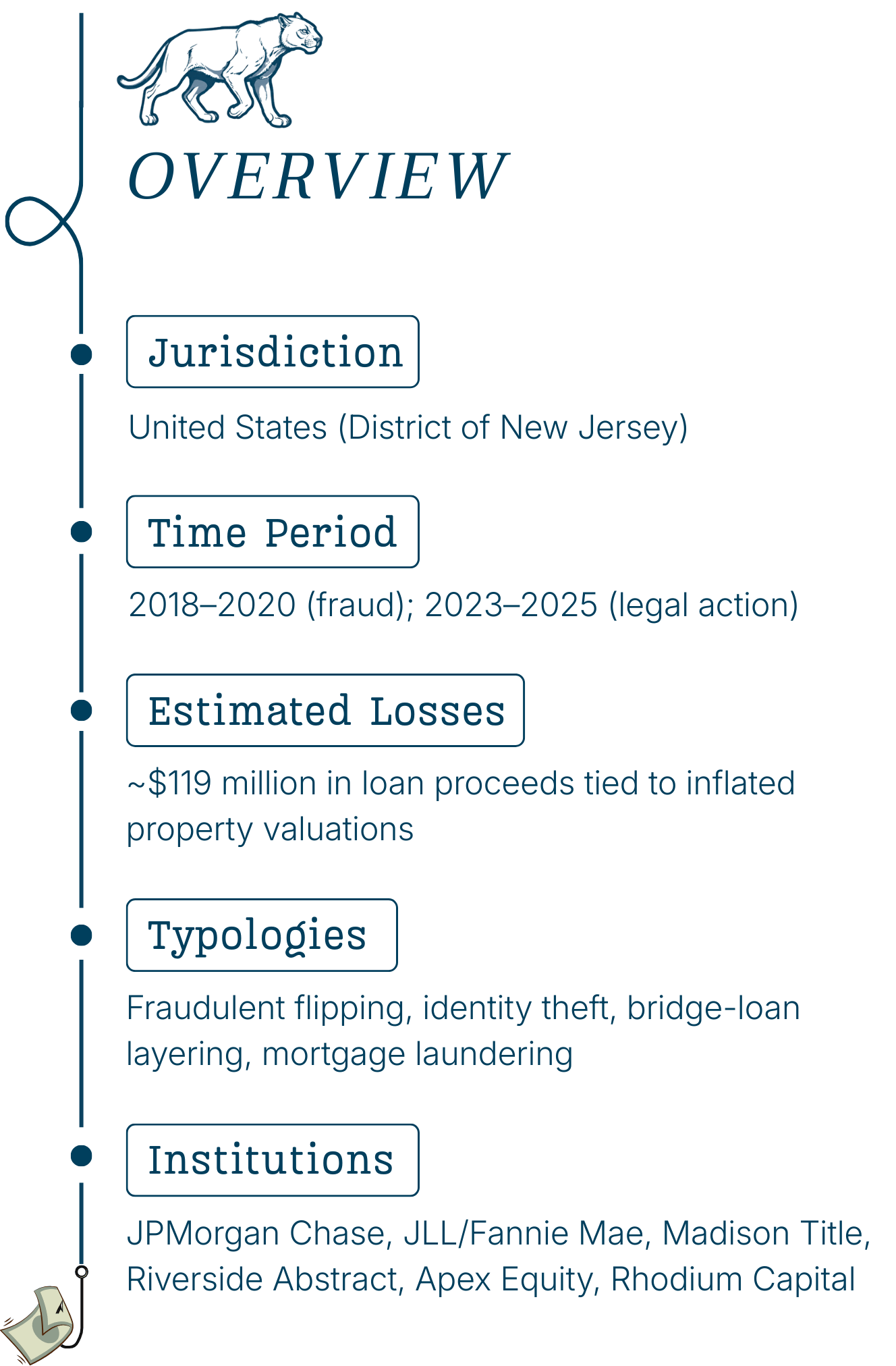

Boruch Drillman, a Brooklyn real estate investor, and four associates orchestrated a massive mortgage fraud scheme using fake property sales, forged documents, and short-term loans disguised as cash. They tricked big lenders into issuing over $119 million in loans by pretending properties were worth much more than they were.

The scam fell apart when Drillman turned whistleblower, secretly recording a co-conspirator and handing it to the feds. By 2025, all five were convicted. The case exposed serious flaws in commercial real estate lending and prompted stronger compliance controls across the industry.